Gross pay hourly calculator

It can be used for the. 40 regular hours x 20.

Salary To Hourly Salary Converter Salary Hour Calculators

Gross Pay Hourly Formula.

. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. Ohio has a progressive income tax system with six tax brackets. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period.

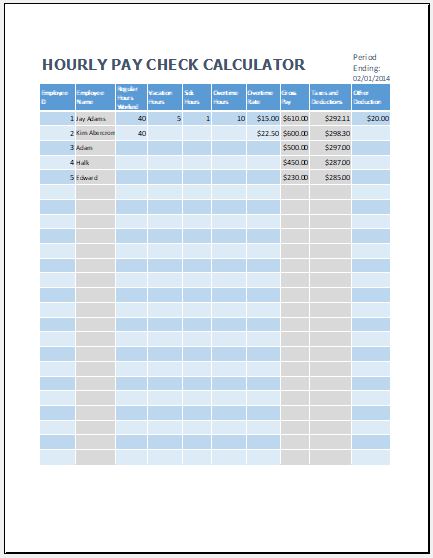

If an employee worked 40 regular hours and 10 overtime hours in one week with a regular pay rate of 20 per hour the calculation would look as follows. Federal Income-- --State Income-- --. Then enter your current payroll information and.

Use this federal gross pay calculator to gross up wages based on net pay. Of overtime hours Overtime rate per hour. First enter the net paycheck you require.

Calculate the Tax Rate. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also.

Or Select a state. It is the sum when computing the yearly gross wage. Gross Pay Hours Hourly Wage Overtime Hours Hourly Wage 15 Commission Bonuses.

For example if an employee receives 500 in take-home pay this calculator can be used to. Calculate your take home pay from hourly wage or salary. -Total gross pay.

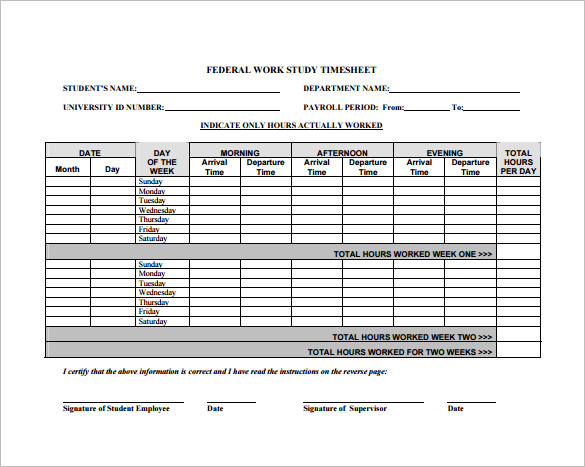

To enter your time card times for a payroll related calculation use this time card. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Gross pay net pay 1 tax rate.

Gross Paycheck --Taxes-- --Details. Divide the salary by the number of paychecks then add any commissions bonuses or additional revenue obtained. For all filers the lowest bracket applies to income up to 25000 and the highest bracket only.

Just enter the wages tax withholdings and other information required. This calculator helps you determine the gross paycheck needed to provide a required net amount. A pay period can be weekly fortnightly or monthly.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. -Overtime gross pay No. Rates range from 0 to 399.

The algorithm behind this hourly paycheck calculator applies the formulas explained below. The formula used to calculate a gross-up is. Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime.

All other pay frequency inputs are assumed to be holidays and vacation. How Your Texas Paycheck Works. Below are four basic steps employers should take when grossing up salaries.

Use ADPs Florida Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. This reduces your gross pay to compensate their obligation to. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly Pay Calculator Clearance 53 Off Ilikepinga Com

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly Paycheck Calculator Step By Step With Examples

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Calculating Income Hourly Wage Youtube

3 Ways To Calculate Your Hourly Rate Wikihow

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Paycheck Calculator Apo Bookkeeping

How To Calculate Gross Pay Youtube

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Salary What Is My Annual Income